The fund only has one investment product, which is set out in the Product Disclosure Statement (PDS). The PDS identifies that the Fund invests in registered first mortgages, on restricted valuation principles, with interest payable quarterly in arrears by borrowers and the net return distributed to investors shortly after the end of each quarter. Excess cash liquidity is held by TPT Wealth as the custodian and invested “on call”.

BMI will use this webpage as a way to effectively and efficiently disclose new information, or changes/amendments relating to either the Responsible Entity or the Funds to all investors. The website will follow the good practice guidance for website disclosure as set by Australian Securities and Investments Commission (ASIC). If new information, updates or amendments are deemed material in nature, a modified PDS relating to the Fund will be created and communicated directly to investors via email.

We know and understand the Tasmanian market especially when it comes to the risks and the property held as security. In most instances our borrowers are known to us. We are diligent and prudent when it comes to the approval of mortgage loans to borrowers.

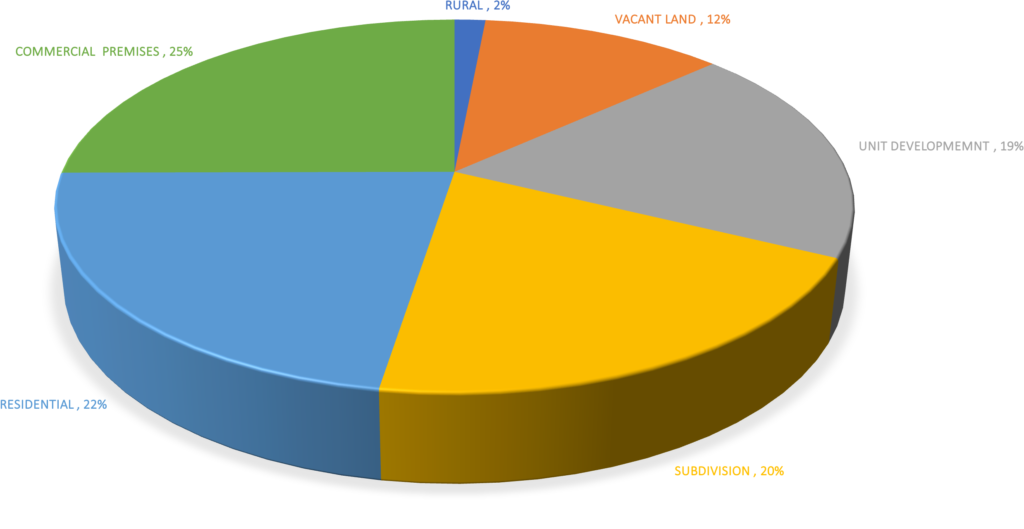

The BMI Lending Committee has established criteria to guide the selection of appropriate loans and security. We have the broad expertise and experience to assess, structure, and manage a commercial transaction, that enables accessing great lending opportunities. Our investment approach includes the diversification of the ‘loan book’ *, which assists in lowering the risk that an adverse event affecting one borrower or one type of loan will simultaneously affect the majority of borrowers, and therefore put the overall loan portfolio at risk.

Investor returns include income in form of quarterly distributions. A complete PDS is available.*

Target Market Determination (TMD)

An investment may be redeemed upon notice subject to any liquidity requirements in the PDS.

Redemption requests can be made by completing and signing an Application for Withdrawal and delivering or sending it to us.

Investment Redemption Authority

* As at 20th Nov 2023